- Single Sided Board

- Eight laminates

- Goldfinger board

- Single-sided PCB

- PCBA

- High density of eight layer,minimum diameter 3MIL

- Six laminates

- Six layers of antioxidant plate

- Six blind buried orifice

- Double black oil spray tin

- Double red plate

- Double blue oil spray tin circuit board

- Four layers of blind and buried vias

- Four layer circuit board spray tin

- Four layer impedance circuit board

- BGA

- six impedance board for Video surveillance

- PCB for POS

- Oxidation multilayer board

- Medical Devices board

- Eight layers of medical equipment board

- Electromechanical control pcb

- PCBA

- FPC

- FPC and PCB

- FPC

- PCBA for smart home

As we all know, copper acts as a negative electrode material carriers and the negative current collector in lithium battery, is an important material for lithium batteries. Since 2015, with the rapid development of electric vehicle industry, power lithium battery industry show explosive growth, demand for copper used in lithium batteries also show explosive trend.

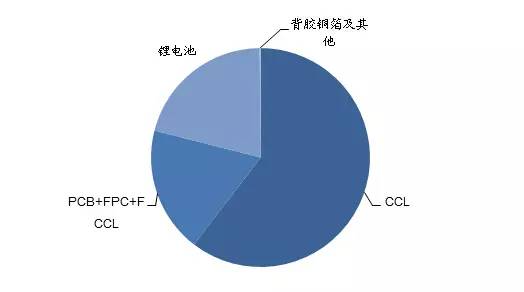

Currently the most widely used two copper industry mainly in the lithium battery market CCL and PCB market. Because lithium and copper foil PCB standards are quite different in the production equipment and technology, lithium foil profits far higher than standard copper PCB, thus many manufacturers prefer to copper foil conversion to lithium industry.

It is reported that Taiwan, South Asia, Changchun, Kim ranks, Mitsui of Japan, Furukawa, Japan and South Korea into, LSM, and China's copper foil crown, Lingbao Huaxin, electronic Qinghai, Jiangxi Copper, copper and other copper joint supply suppliers are lithium foil conversion plan, the provider turn lithium foil can produce a total of about 8600 tons / month.

And a large number of lithium foil CCL demand led to the main raw material shortages and price increases appear foil. Currently the world's copper production capacity at 40,150 tons design / month, slightly lower than the total demand of 43,050 tons downstream / month. Copper foil downstream applications, the demand for copper from CCL CCL's largest, about 26,000 tons per month, PCB + FPC + FCCL foil demand of about 8,000 tons / month.

Copper manufacturers in the total capacity under the same circumstances, after converting the lithium foil (total amount of lithium present scheme to 8600 tons / month), will result in PCB copper supply dropped, unable to meet the needs of downstream CCL and PCB production.

It is expected to 2018, a substantial increase in demand for lithium foil of 200% -300%, while the rate of expansion of copper production capacity of 4% -5%, can not meet the lithium industry and peripheral products for copper demand, and will further lead to other industries especially CCL's copper supply and demand imbalance, thereby causing a corresponding supply of copper prices.

While copper accounted for 30% of the CCL CCL material costs (thick CCL) -50% (thin CCL) CCL account for about 40% PCB production costs, copper prices continued to rise upstream of the transfer to the industry and CCL PCB industry.

It is understood that Guangdong's recently Kingboard Chemical Sales Co., Ltd. Jian-tao Laminates publish notice of price increases, due to rising raw material prices, from July 29 onwards orders for all material price adjustment.

PCB industry has been fierce competition, changes in the copper market is no different for the PCB industry worse.

CCL the total PCB production costs by about 40%, the greatest impact on the cost of the PCB, although large-scale PCB plant will sign a long-term cooperation agreement with CCL plants, but all manufacturers of raw materials will still lead to shortages because of the copper foil CCL capacity reduction the price increases and reduce PCB enterprises and supply of copper sheet.